T1 Energy (TE) Valuation Check As Chief Accounting Officer Exit Triggers Finance Leadership Transition

T1 Energy (TE) is back in focus after the abrupt exit of Chief Accounting Officer Denise Cruz and the same-day promotion of SEC reporting lead Tom Mahrer to the top accounting role.

See our latest analysis for T1 Energy.

The leadership shake up is landing at a time when momentum in T1 Energy’s shares has been strong, with the 90 day share price return of 83.78% and 1 month share price return of 19.16% far outpacing the more modest year to date move. This sits alongside a very large 1 year total shareholder return, while longer term 3 and 5 year total shareholder returns remain negative.

If executive changes have you reassessing the sector, this could be a good moment to look across the energy transition space using our list of 24 power grid technology and infrastructure stocks as another set of ideas to research.

With T1 Energy trading at US$8.27 against an analyst price target of US$10.50 and an intrinsic value estimate suggesting a sizeable discount, you have to ask: is there genuine value here, or is the market already pricing in future growth?

Most Popular Narrative: 21.2% Undervalued

At $8.27 versus a narrative fair value of $10.50, the widely followed view frames T1 Energy as materially discounted, with that gap tied to ambitious expansion plans and policy support.

The development of the 5 GW G2_Austin facility and ramp-up at G1_Dallas are creating line-of-sight to significant capacity expansion, allowing T1 to capitalize on the electricity demand supercycle and scale EBITDA meaningfully over the coming years as new production comes online.

Read the complete narrative.

Want to see what sits behind that capacity story, the contract pipeline, and the margin assumptions baked into this fair value? The core narrative leans heavily on rapid revenue compounding, improving profitability from loss making levels, and a future earnings multiple that still undercuts many peers.

Result: Fair Value of $10.50 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this bullish setup still leans heavily on continued US policy support, as well as successful financing and ramp up of G2_Austin, where delays could quickly test sentiment.

Find out about the key risks to this T1 Energy narrative.

Another View On Valuation

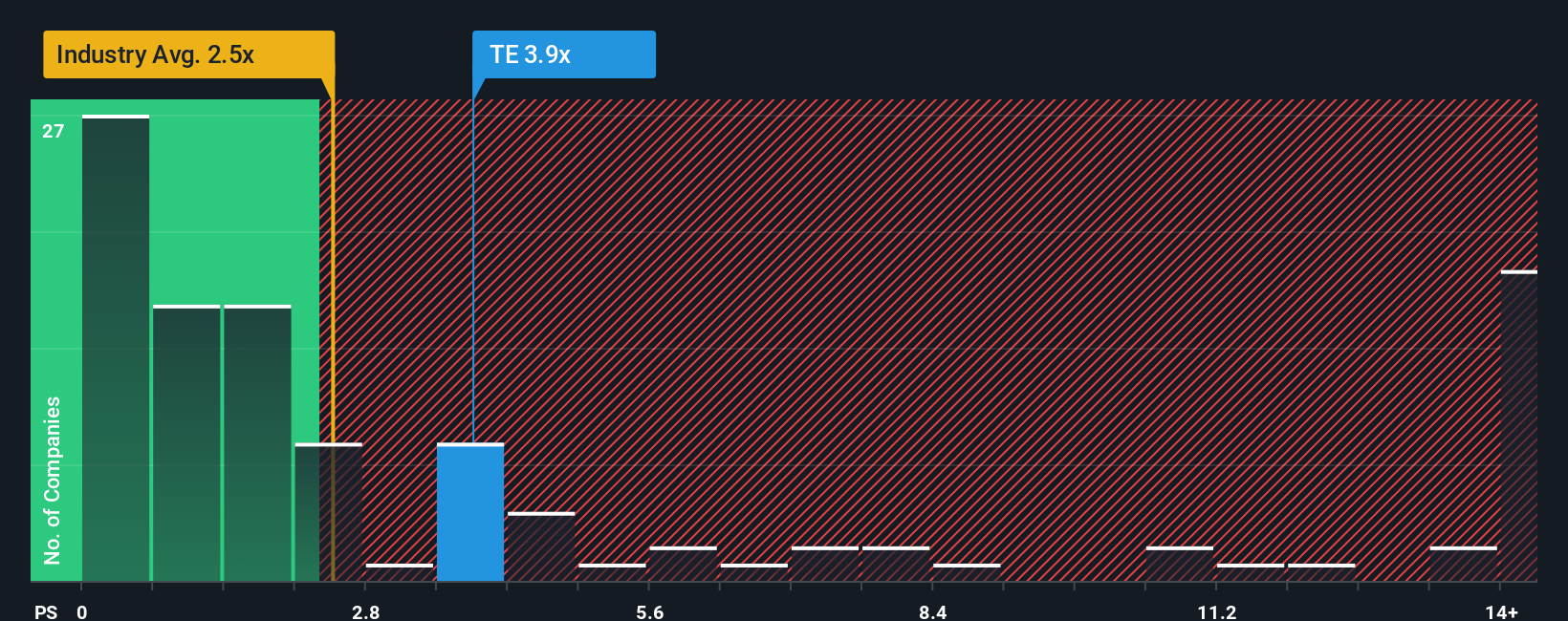

That first fair value narrative leans heavily on growth and policy support, but the P/S ratio tells a different story. At 5.6x, T1 Energy trades at more than double the US Electrical industry average of 2.5x, and still sits above its own 4.6x fair ratio, which suggests some valuation risk if sentiment cools.

In contrast, the same 5.6x P/S looks low compared to a peer average of 28.4x, which shows how wide the range of outcomes might be. So is the current price a cushion against downside, or a premium that only works if the growth case plays out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you see the numbers differently, or simply want to test your own assumptions against the data, you can build a custom thesis in minutes: Do it your way.

A great starting point for your T1 Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If T1 Energy has caught your attention, do not stop there. Broaden your watchlist with fresh ideas that could complement or balance your current research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if T1 Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link