Top Accounting Trends And Takeaways From The SEC And Financial Reporting Conference – Accounting Standards – Accounting and Audit

This month, Riveron sponsored and presented at the

42nd Annual SEC and Financial Reporting Conference

hosted by the University of Southern California Leventhal School of

Accounting and the Financial Executives Institute (FEI).

The conference themes spanned materiality, evolving standards,

internal controls over financial reporting, and more. Riveron

experts have compiled key takeaways from the conference that will

be relevant for accounting and finance professionals preparing for

their companies’ quarterly and annual reporting.

In addition to Riveron’s presentation on artificial intelligence for CFOs and

controllers, the conference featured insights from accounting

industry leaders. These included the US Securities and Exchange

Commission (SEC) staff, members of the Financial Accounting

Standards Board (FASB), Fortune 100 finance and accounting

executives, and representatives from the top national accounting

firms.

The gathering provided an excellent opportunity to hear from

accounting leaders on the latest themes emerging from busy season

as companies refine their financial reporting practices and look

toward preparing for year end. Here are the important conference

takeaways for the office of the CFO:

Risk assessments, in-progress projects, and other topics

explored at the SEC and FASB leaders’ fireside chat

The conference began with a fireside chat featuring the SEC

Chief Accountant Paul Munter and FASB Chair Rich Jones. Both

leaders reiterated themes they had previously highlighted at the 2023 SEC conference.

Munter discussed several statements issued by his office,

addressing various practice issues from rigor in the statement of

cash flows to the tone at the top of accounting firms. He

emphasized that the accounting profession must prioritize quality

financial reporting, integrity, and professionalism over

growth.

Specifically, Munter highlighted the importance of financial

statement preparers and auditors performing a quality risk assessment. He commented that, in some

circumstances, the risk assessment process is too focused on a

narrow scope of information while not considering broader economic

circumstances that may impact the analysis. A holistic risk

assessment should consider the activities and results of companies

and examine the dynamic environment in which they

operate.

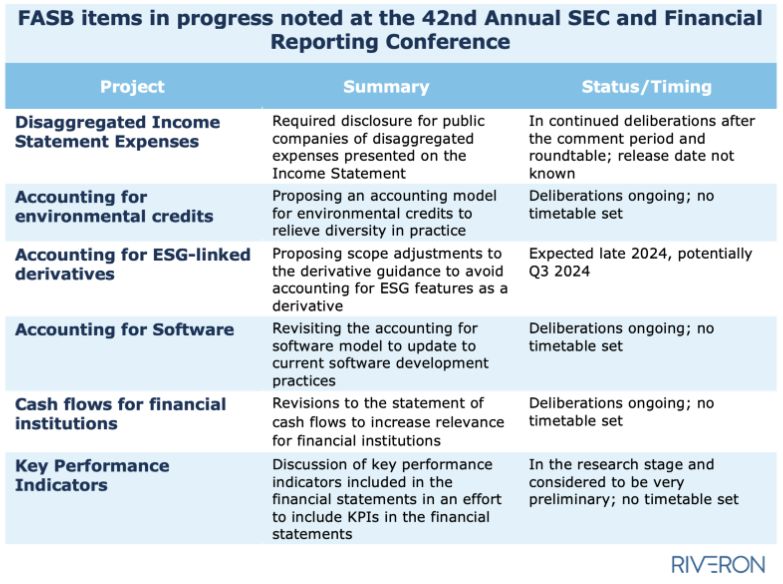

Rich Jones, the FASB Chair, highlighted the current FASB agenda.

He noted that, upon assuming his role, the FASB conducted an

outreach effort to identify topics relevant to investors and

preparers, ensuring that the FASB agenda output benefits investors.

Jones also mentioned the reconstituted Emerging Issues Task Force (EITF), which

addresses practice issues more swiftly and integrates them into the

FASB agenda with suggested solutions.

Jones outlined several projects in progress, including the

following:

Jones also highlighted several recently issued standards,

including the standard on digital assets, as an example of how the

FASB continues to look for ways to be responsive to industry

demands.

Current practice takeaways included materiality, data, and

internal controls

Beyond the presentations from the SEC Chief Accountant and FASB

Chair, the attendees heard from a panel of accounting firm leaders

regarding current practice and audit issues, a controllership

panel, and from the SEC Chief Accountant of the Enforcement

Division. The presentations covered a variety of topics and

concerns in current practice. Topics of note throughout the day

included:

Materiality: From cybersecurity to climate disclosures to the evaluation of a

misstatement, a thorough and objective assessment and documentation

of materiality is critical. In certain areas such as cybersecurity

and climate disclosures, defining materiality is a novel concept

and will take significant work with key stakeholders outside of the

financial reporting department. When it comes to the financial

statements, there continues to be significant SEC focus on the

evaluation of materiality with regards to evaluation of a

misstatement utilizing the guidance in SAB 99. The staff underscored that these

assessments should not be viewed as something that a company can

simply “document their way out of” but require objective

assessments of quantitative and qualitative factors, if

relevant.

Data Management and Systems: While the

conference did not dwell on the general shortage of accounting

talent, it did highlight strategies to cope with these shortages.

One key strategy is the implementation of robust data management

practices. Effective data management contributes to reliable

financial reporting and helps mitigate the impact of talent

shortages. For instance, Riveron led a discussion on AI in

Accounting that explored various use cases beyond large language models,

focusing on automating processes and enhancing data validation. The

controller roundtable further emphasized the importance of systems

that manage data effectively and the need for financial reporting

teams to rigorously validate that data. Good data practices are

essential for ensuring the accuracy and reliability of financial

reports, especially in an environment where accounting resources

are stretched thin.

Internal Controls over Financial Reporting:

Internal controls over financial reporting (ICFR) was a major focus

throughout the panels, highlighting several key problem areas:

- Sufficient Personnel and Expertise: Ensuring

teams have the right personnel with the necessary expertise is

crucial, particularly amid current talent shortages. - Adequate Resources: Sufficient resources,

including access to technology and AI, are essential to support

robust internal controls. - Information Flow: Critical information must

reach the appropriate individuals for informed

decision-making. - Integration of Acquired Systems: Effective

controls are necessary to ensure accurate financial data during

system integrations. - Cybersecurity Disclosures: Accurate and timely

disclosures are vital in the face of increasing cyber threats. - Risk Factor Disclosures: Properly identifying

and disclosing risk factors is essential for transparent financial

reporting.

Preparers should consider the total communication to investors,

beyond just the audited financials and footnotes. Investing in ICFR

and disclosure controls and procedures (DCP) can help identify

problems early, leading to better reporting and fewer issues

escalating to the division of enforcement.

Recurring conference topics relevant for the office of the

CFO

In addition to the key themes noted above, the conference

participants briefly mentioned several topics that often arise at

these events. The office of the CFO should continue to monitor

these topics throughout the year to ensure accounting and financial

reporting practices are aligned to the latest guidance.

SEC comment letter trends are a common subject

closely followed by preparers, and the following topics were

highlighted during the conference:

Emerging areas of comments, including:

“Evergreen” topics that continue to be a focus:

Additionally, the Division of Corporate Finance indicated other

trending consultation topics, which included:

- New SEC clawback rules and the use of the cover page

checkboxes - New segment reporting guidance and the application

of the guidance to Non-GAAP measures - Cybersecurity breaches and 8-K disclosures

Overall, the 42nd Annual SEC and Financial Reporting Conference

offered valuable insights from key regulators, standard-setters,

and industry leaders. While some topics remain consistent, the

focus on emerging issues highlights the ever-evolving financial

reporting landscape. Companies must stay vigilant and proactive in

their reporting practices to navigate these changes

effectively.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

link